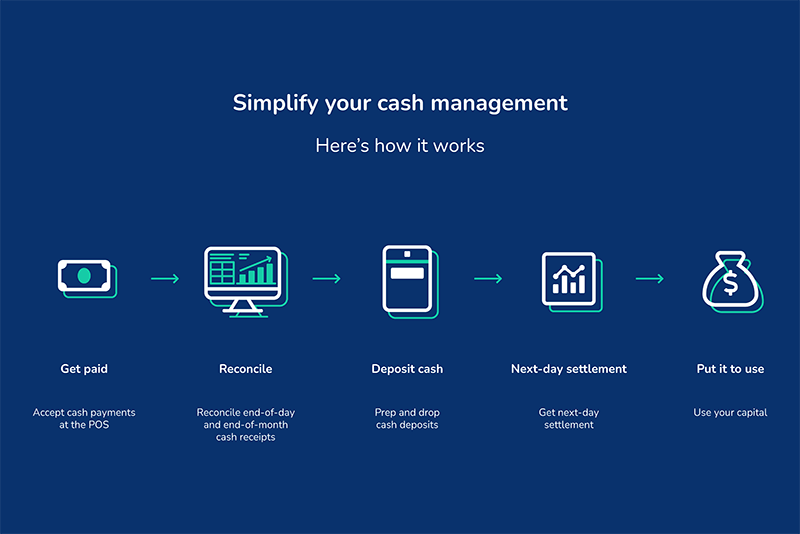

Managing cash is now easier than ever for merchants that use Clover from Fiserv point-of-sale (POS) and business management systems. Thanks to an application integration between Clover and BLUbeem by Brink’s digitized cash management app, you can digitally reconcile cash sales, all from your Clover POS. While small to mid-sized businesses face a variety of challenges, this app brings the benefits of BLUbeem Cash to the POS and helps ease some of the particular inconveniences that come with managing cash payments. Here are four business pain points likely hurting you that the BLUbeem app for Clover solves.

-

Complicated manual cash reporting and reconciliation

Imagine getting back hours in your day to spend more time at home with your family. It would be pretty nice, right? For many merchants, a manager may spend time each day checking their point-of-sale receipts against the cash they are about to deposit at the bank. The owner may follow up on this manual tracking a second time. Reconciling cash payments and bank deposits the old-fashioned way is a tedious process that involves tracking down receipts and comparing them to the amount deposited in the smart safe. Find an error? Good luck figuring out where it came from. With BLUbeem, we digitally track your cash sales, and provide you with a side-by-side perspective so that you can more easily reconcile cash sales quickly and from within the same platform, giving yourself or your employees more time to focus on what matters most. -

Never-ending bank trips to make deposits

You’ve probably heard the phrase, “While the cat is away, the mice will play.” Do you see a reduction in store performance when you or an important manager are out of the store? Many businesses today are making bank trips daily – cutting into valuable store time. Or worse, you may be relying on an employee to drop that deposit off on their way home from work. Thanks to BLUbeem’s secure smart safe, you can conveniently drop cash in-store, without having to step foot outside. The smart safe goes hand-in-hand with our app, which allows you to enter cash amounts and see where they are once they’ve been picked up by our messengers. Cutting out bank trips means saving time as well as minimizing risks like theft and loss. -

Painful time gaps between when cash is deposited and when it’s available

Waiting around for bank deposits to post to your account is a thing of yesterday. BLUbeem gives you next-day access to your cash via advance credit, added to any bank account of your choice. This allows you to access your cash faster and use it toward paying business bills or anything your business may need.

-

Lack of visibility into your cash

Imagine trying to pack for an out-of-state trip without checking the weather forecast first. It wouldn’t be the best decision, and what ended up in your suitcase would be based on a blind guess that could leave you both uncomfortable and unprepared. Not knowing your cash situation and trying to make big decisions could leave you in a similar bind -- without a detailed look into how much cash your business has on hand, it’s hard to have a solid grasp of your cash flow to make important financial decisions. From our POS app, you get a full picture of how much is inside your cash drawer, along with how much has been added to your smart safe and how much has been credited.

The bottom line

With transactions and cash data together in one place, you’ll save time and money while improving visibility. And when you’re running a business, having access to those benefits, all from your POS, is hard to beat.

Talk to us to get the full scoop.